The NFT Hype—a Revolutionary Market

Everything you need to know about Non-Fungible Tokens

What are NFTs?

We are all familiar with the Nyan Cat, the emergence and growth of NFTs and how similar viral digital arts are being sold all over the internet. This explosive proliferation of blockchain technology has taken the world by storm.

NFTs or Non-Fungible Tokens are assets with a unique identity in the digital world. Non-fungible means that it is unique and cannot be replaced with something else. Meanwhile, fungible assets are units that can be readily interchanged like money. A $10 note has the same value as two $5 notes. Bitcoins are also fungible—one can be traded for another.

NFTs are one-of-a-kind assets in the digital world that can be bought and sold like any other piece of property but which have no tangible form of their own. These digital tokens can be thought of as certificates of ownership for virtual or physical assets.

In simpler terms, NFTs are tokens that we can use to represent the proprietorship of unique items. They let us tokenise things like art, collectibles, and even real estate.

How do NFTs work?

NFTs are a part of the Ethereum blockchain. So, they are just individual tokens with extra information. This additional information can take the form of art, music, video, or any other asset. As they hold value, they can be bought and sold just like other types of art. The market and demand primarily set the value. Most NFTs reside on the Ethereum cryptocurrency’s blockchain, which creates permanent digital records of all transactions using that cryptocurrency and an irrefutable ledger of NFT transactions. Essentially, NFTs are like physical collector’s items, only digital. So instead of getting an actual oil painting to hang on the wall, the buyer receives a digital file instead.

An NFT could represent many things

- Digital art like GIFs, collectibles, music, videos and virtual avatars, and video game skins

- Real-world items like deeds to a car, tickets to a real-world event, tokenised invoices, legal documents and signatures

An NFT can only have one holder at a time. It is managed through the uniqueID and metadata that no other token can replicate. NFTs are said to be minted through smart contracts that assign claims and manage the transferability of the NFT’s.

The minting process mentioned earlier has the following steps

- Creating a new block

- Validating information

- Recording information into the blockchain

When someone creates an NFT, they execute code stored in smart contracts that conform to different standards. This information is added to the blockchain where the NFT is being managed.

The creator of an NFT decides the scarcity of their asset. They retain the copyright for it and the right to duplicate it as many times as they want. If the buyer of the NFT intends to make copies, they need to get permission from the creator, and each copy is considered a unique NFT. Just like physical collectibles, replications will not be as valuable as the original.

Some famous NFTs

Certain NFTs are world-renowned due to their viral and amusing nature.

- Disaster Girl meme ($500,000)

Zoë Roth, the woman whose picture went viral as the 2005 Disaster Girl meme, has sold the original photo for $473,000 to pay student loans

- Everydays: the First 5000 Days ($69.3 million)

Everydays: The First 5000 Days is a JPG file that contains a collage of images created by Beeple

- CryptoPunk #3100 ($7.58 Million)

CryptoPunk is a one-of-a-kind creature that belongs to a group of nine aliens

- The First Tweet ($2.9 Million)

The first tweet sent out by Twitter creator Jack Dorsey has been sold to a Malaysian businessman

- Death Dip ($1.58 million)

Death Drip was the 14th NFT available on the SuperRare site, and it is now the most expensive

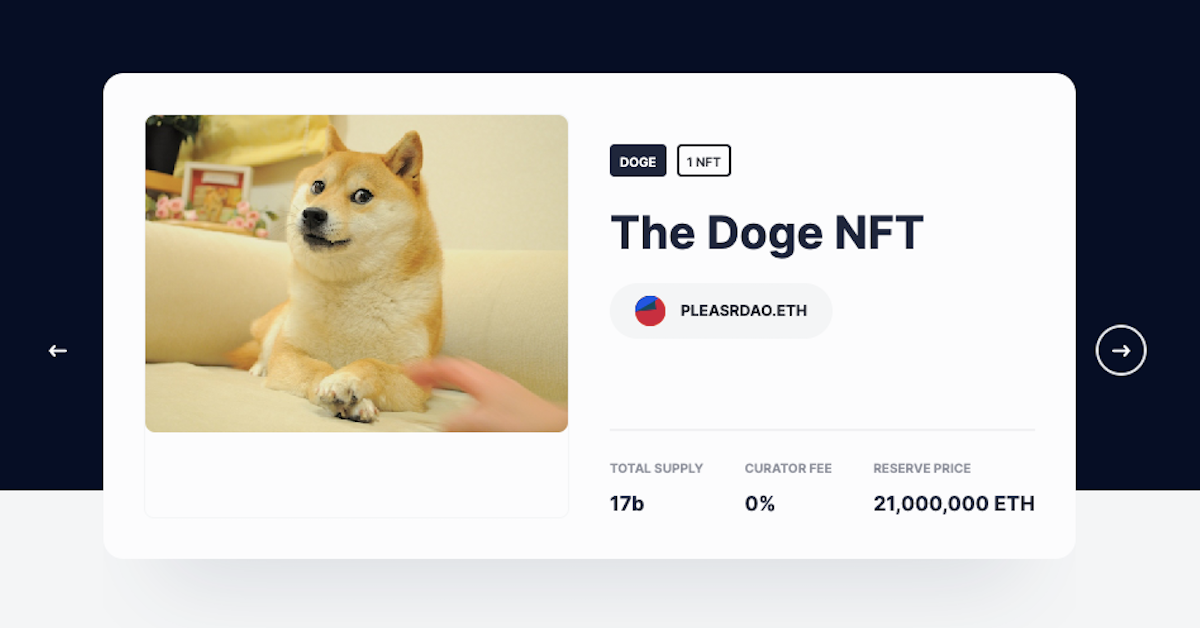

- Doge ($4,000,000)

Sold in early June 2021, Doge placed a bid of 1,696.9 ETH, which is an incredible amount of cryptocurrency to spend on anything, let alone a picture of one of the internet’s most well-known memes

The two sides of NFTs

NFTs aim to invent a market that potentially expands beyond boundaries and identities. However, they also carry their own share of pros and cons.

NFTs give artists the right over their digital assets, providing them with a chance to show authenticity and generate profit from their work. With memes, for example, being widely circulated, this could mean a significant income stream for the creator. They are unique and collectible, creating assets with diversity.

NFTs are immutable. Because NFTs are blockchain-based, they can never be altered or replaced. NFTs can include smart contracts. They can store instructions that are executed when certain conditions are met. An NFT with a smart contract could give artists profit when the NFT is sold in the future. They help create a New Revenue Stream for artists. NFTs were partially designed to help artists earn more money in a digital landscape.

While NFTs are popular, the field itself is a work in progress. It is a speculative market. The question remains whether there is any actual value in NFTs—if they are a long-term investment or simply a fad. Digital assets can be copied. Just because you own the NFT does not mean you control the asset—you merely have a token of authenticity.

It takes a lot of computing power to enter records onto a blockchain, so there are uncertainties about whether assets based on blockchain are sustainable. They also carry the risk of being stolen. They have been the target of a few security breaches. At present, it is impossible to gauge NTFs as a worthy long-term investment. Just because someone owns an original NFT does not mean they can control its distribution or duplication across platforms.

The hype of NFTs—is it over or is it just the beginning?

The earliest NFTs to be made were a series of PFPs- profile pictures designed to be used as avatars for social media. In comparison to those times, we have come a long way. In May 2021 people were buying and selling an estimated 85,787 NFTs—at a total value of $5.8 million—a day, according to application tracking firm DappRadar.

Cryptocurrencies and blockchain technology both have been very instrumental in making NFTs the next big thing. As the volatile market continues to self-correct, the NFT format sees new and promising use cases beyond the art world.

However, data also reveals that the NFT hype is still as uncertain as to the year’s beginning. Overall sales plunged from a seven-day peak of $176 million on May 9 to just $8.7 million on June 15, according to numbers from Nonfungible.

While NFTs have greater heights to climb, they have nevertheless been an efficient way of conducting business. Blockchain technology aids the transaction process. NFTs are basically what we always wanted all along when investing in art, sports cards and practically any other asset.

Written by: Garima Kejriwal and Lavanya Rao